Research

What is XRP? Learn how XRP works, its tokenomics, use cases, and how to buy and store it safely.

Understanding XRP requires examining both the digital asset and the distributed ledger that powers it. XRP is a payment-oriented digital asset engineered for fast settlement, predictable throughput, and cost-efficient global value transfer. It operates on the XRP Ledger, a decentralized blockchain engineered for low-latency transactions and cost-efficient settlement.

This review delivers a technically grounded breakdown of XRP crypto, covering consensus mechanics, XRP tokenomics, adoption, custody, derivative markets, and risk considerations. It is designed for developers, DeFi users, traders, and crypto-aware readers seeking a review of the XRP cryptocurrency based on clarity rather than speculation.

What is XRP?

XRP is a digital asset introduced in 2012 as part of a broader initiative to build a scalable payment infrastructure. It was initially developed by early contributors to Ripple Labs; however, the XRP Ledger (XRPL) operates as an independent distributed ledger governed by network validators rather than any single corporate entity. XRP’s core purpose is to enable rapid value settlement and serve as a pathway for cross-border payments and multi-asset liquidity flows. With deterministic finality and low fees, XRP is often positioned as a high-performance alternative to legacy payment rails.

Ripple and XRPL ecosystem materials position the network as a programmable, enterprise-oriented settlement system. This article is part of a comprehensive review of the XRP cryptocurrency, focusing on how the network compares to modern blockchain architectures.

How Does XRP Work?

A key question for most readers is: how does XRP work at the protocol and network level?

The XRP Ledger is a specialized Layer 1 blockchain optimized for payments, asset issuance, and on-chain exchange functionality. Its architecture prioritizes:

Ledger closes every ~3–5 seconds

Deterministic finality (no probabilistic confirmations)

Minimal fees

Consistent throughput suitable for global payment routing

XRPL supports features such as decentralized exchange (DEX) functions, issued assets, and pathfinding algorithms that direct payments across accounts.

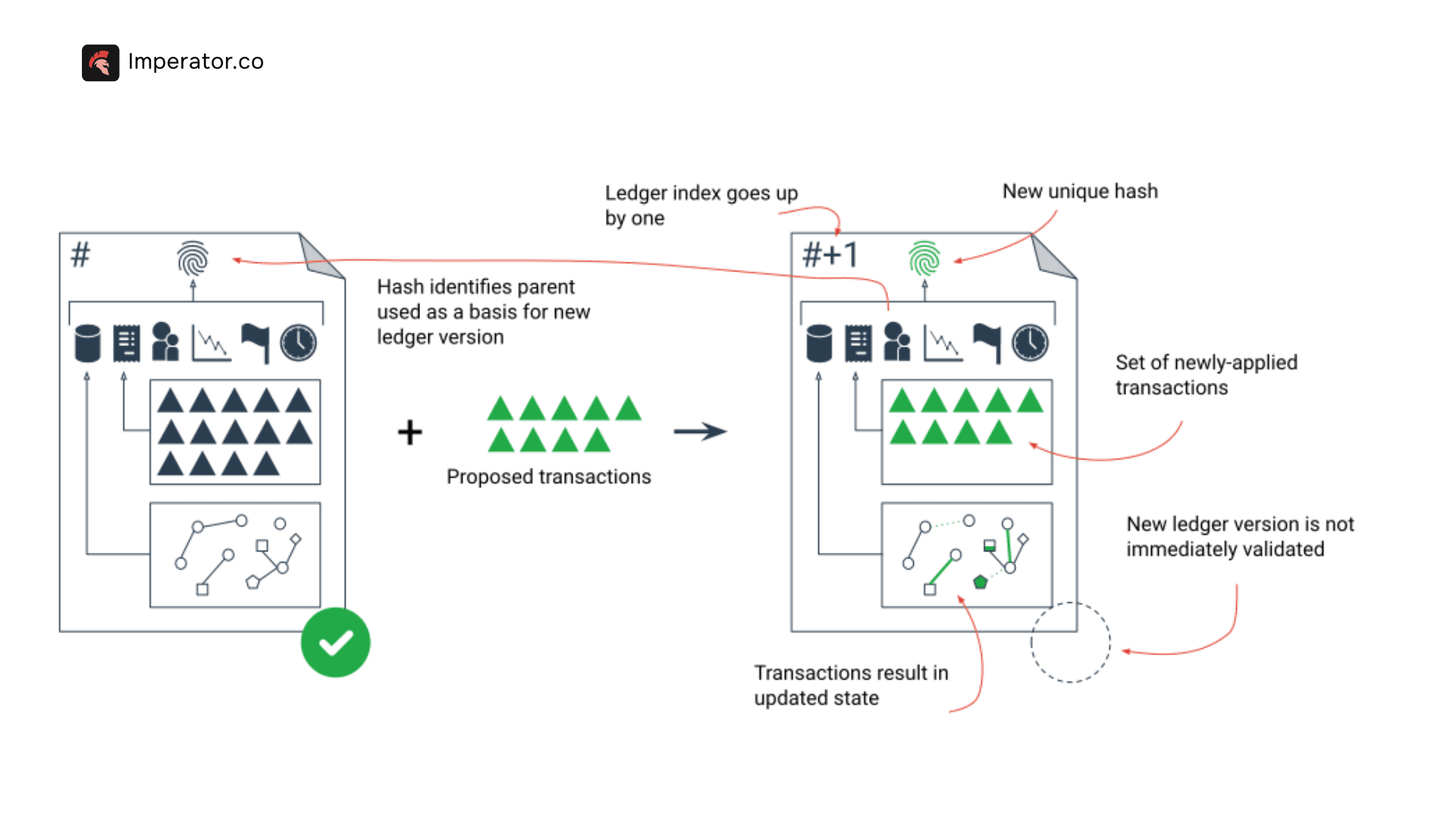

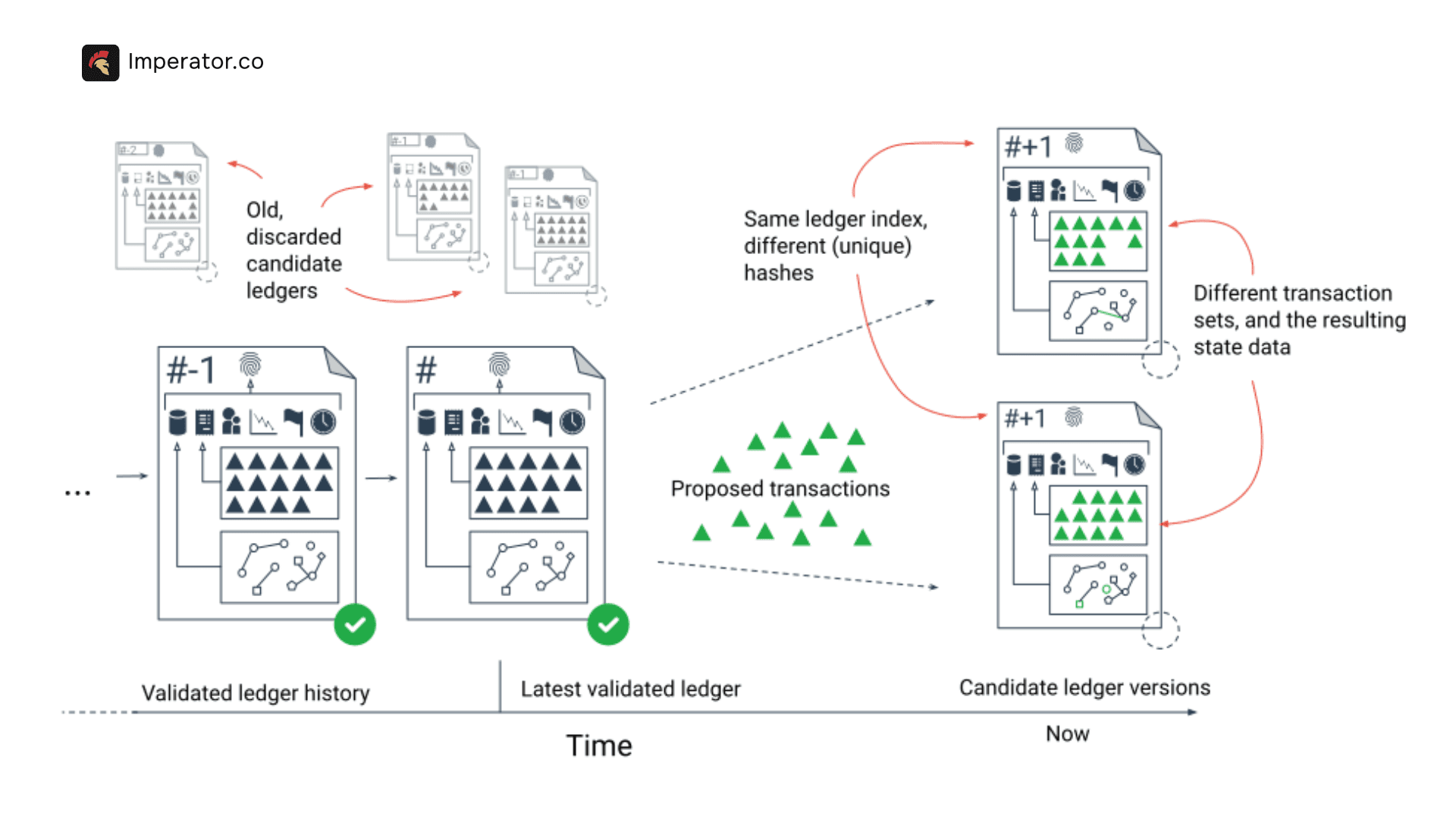

Consensus Model: UNL Agreement

XRPL uses a Unique Node List (UNL) consensus model rather than proof-of-work (PoW) or proof-of-stake (PoS). Validators agree on transaction ordering by communicating with trusted nodes on their UNL.

This results in:

Fast settlement

Low-energy operation

A trust-weighted security model distinct from permissionless PoW/PoS systems

A critical nuance: XRPL’s decentralization model differs from large validator sets found in networks like Ethereum. Because UNL composition impacts safety assumptions, decentralization must be understood as a spectrum rather than a binary attribute.

Performance Characteristics

The network consistently provides:

Settlement finality in ~3–5 seconds

Very low fees (often < $0.01)

Practical throughput of around 1,500 transactions per second (TPS) for simple payment operations

Common XRP Use Cases

Key XRP use cases include:

Payments and treasury settlement

Liquidity bridging between fiat rails

On-ledger swaps using built-in decentralized trading functions

FX routing

Multi-asset remittances

XRP Tokenomics and Supply

The design of XRP tokenomics is critical to understanding XRP’s behavior and long-term dynamics. Every XRP transaction incurs a tiny fee, which is permanently removed from the supply rather than paid to validators.

Supply Overview

Total supply: 100 billion XRP

No mining; the entire supply was created at genesis

Circulating supply has increased over time as XRP allocated to Ripple and early contributors, including tokens released from Ripple’s escrow, enter the market, while a small amount of XRP is permanently destroyed as transaction fees.

Initial Distribution

The founding team allocated portions of the supply to developers, early contributors, and Ripple Labs. These distributions have influenced liquidity and exchange availability over the past decade.

Escrow and Release Mechanism

Ripple Labs placed a significant amount of XRP into a time-based escrow, locking 55 billion XRP into a cryptographic escrow. Each month, up to 1 billion XRP is released, with unused amounts returned to escrow.

The schedule makes releases predictable, but market impact is not predictable, because only a portion enters active liquidity via exchanges or OTC channels.

Investment Framing

The question, “Is XRP a good investment?” requires evaluating utility, network reliability, and adoption, while recognizing that escrow behavior, governance debates, and regulatory actions contribute to uncertainty.

0 clients stake with Imperator.co

0 clients stake with Imperator.co

Start staking with Imperator and maximize your rewards.

XRP Use Cases and Real-World Adoption

Cross-Border Payments

XRP for cross-border payments remains the most cited application. It leverages the asset’s speed and low fees for remittances, liquidity bridging, and real-time FX flows. Its primary advantage is achieving efficient multi-currency settlement with fewer intermediaries than traditional correspondent-bank systems.

Institutional and Enterprise Use

Payment processors, remittance companies, and fintech platforms have tested or integrated XRPL features for treasury flows, settlement optimization, and interoperability.

Retail Trading and Speculation

XRP crypto is widely traded across CEXs and DEX platforms. Its deep liquidity and long-term market presence make it popular among traders using spot, derivatives, or leveraged exposure.

Developer-Oriented Use

Developers leverage XRPL’s native features, such as payment channels, pathfinding algorithms, and on-ledger swaps, to build payment apps, micropayment systems, and value-transfer tooling.

How to Buy and Store XRP Safely

As a user seeking guidance on how to buy XRP and how to store XRP safely, consider the following:

Buying XRP

Typical venues include:

Centralized exchanges (primary source)

Wrapped XRP on certain DEXs

Brokerage apps enabling crypto purchases

Self-Custody and Wallet Options

Safe storage requires a wallet that supports XRPL. Options include:

Hardware wallets (highest safety)

Non-custodial mobile or desktop wallets

Developer tooling (CLI, SDK wallets) for advanced users

Best Practices for Security

To improve self-custody safety:

Back up seed phrases offline and redundantly

Verify destination tags before sending XRP

Avoid mixing custodial and personal addresses without proper verification

Use hardware wallets for large holdings

Users often lose funds due to incorrect tags, misconfigured transactions, or phishing attempts; mistakes that can be mitigated through discipline and verification.

Where XRP Fits in Perpetual Trading

Traders seeking more dynamic exposure access XRP via perpetuals, enabling leveraged long or short positions.

How Perpetuals Operate

Perpetuals use margin and funding-rate mechanics to balance long and short positioning. XRP’s long-standing market presence contributes to relatively strong liquidity; however, this can vary across venues.

On-Chain Trading Venues

Platforms such as Hyperliquid offer on-chain XRP perpetuals, combining transparent settlement with efficient on-chain trading. Builder codes and streamlined wallet integrations improve execution flows and user experience.

Spot vs Perpetuals

Spot markets reflect direct asset ownership, whereas perpetual futures provide directional exposure without requiring the holding of XRP. Perpetual markets carry amplified risk but offer flexibility for hedging and short-term positioning.

XRP Risks

Analyzing XRP risks is essential for users evaluating its role.

Technical Risks

UNL trust dependencies

Reliance on a smaller validator set vs large PoS networks

Potential for configuration centralization if operators rely on similar UNLs

Regulatory Risks

XRP has been the subject of high-profile U.S. regulatory actions. Jurisdictional interpretations have influenced exchange listings and institutional access. This adds uncertainty and should be factored into risk assessment.

Market Risks

Volatility

Shifts in liquidity across exchanges

Escrow releases that increase supply exposure

Security Risks

Self-custody requires strict operational security. Errors in wallet management often lead to irreversible loss.

Discover all our Staking Opportunities

Acces over 50+ protocols to maximize your staking returns

Closing Thoughts on XRP

Compared to other settlement-focused blockchains, XRP’s fast finality and liquidity-routing capabilities remain distinguishing features for developers, traders, and institutional participants. Its role within a diversified crypto stack depends on the user’s tolerance for regulatory exposure, trust-model preferences, and settlement needs.FAQs

1. Is XRP a good investment?

It depends on utility alignment, adoption trends, and individual risk tolerance. XRP offers strong settlement properties but carries regulatory and market risks. Users weigh the risks of XRP and regulatory factors before making decisions.

2. How does the XRP Ledger differ from other blockchains?

The XRP Ledger employs a UNL-based consensus model with deterministic finality, low latency, and embedded DEX functions, which give XRP unique efficiency characteristics distinct from those of PoW/PoS systems.

3. How long do XRP transactions take?

Most XRP transactions settle within 3–5 seconds due to XRPL’s high throughput and deterministic finality.

4. What are the risks of holding XRP?

Key XRP risks include regulatory uncertainty, critiques of the UNL trust model, liquidity shifts, and user-side security vulnerabilities associated with self-custody.

$0 assets under managment

$0 assets under managment

Join investors who trust Imperator to maximize their returns. Take the first step today.