Research

Explore Circle’s Arc L1 built for stablecoin finance with USDC gas, Malachite BFT deterministic finality, built in FX, opt in privacy, plus CCTP and Gateway.

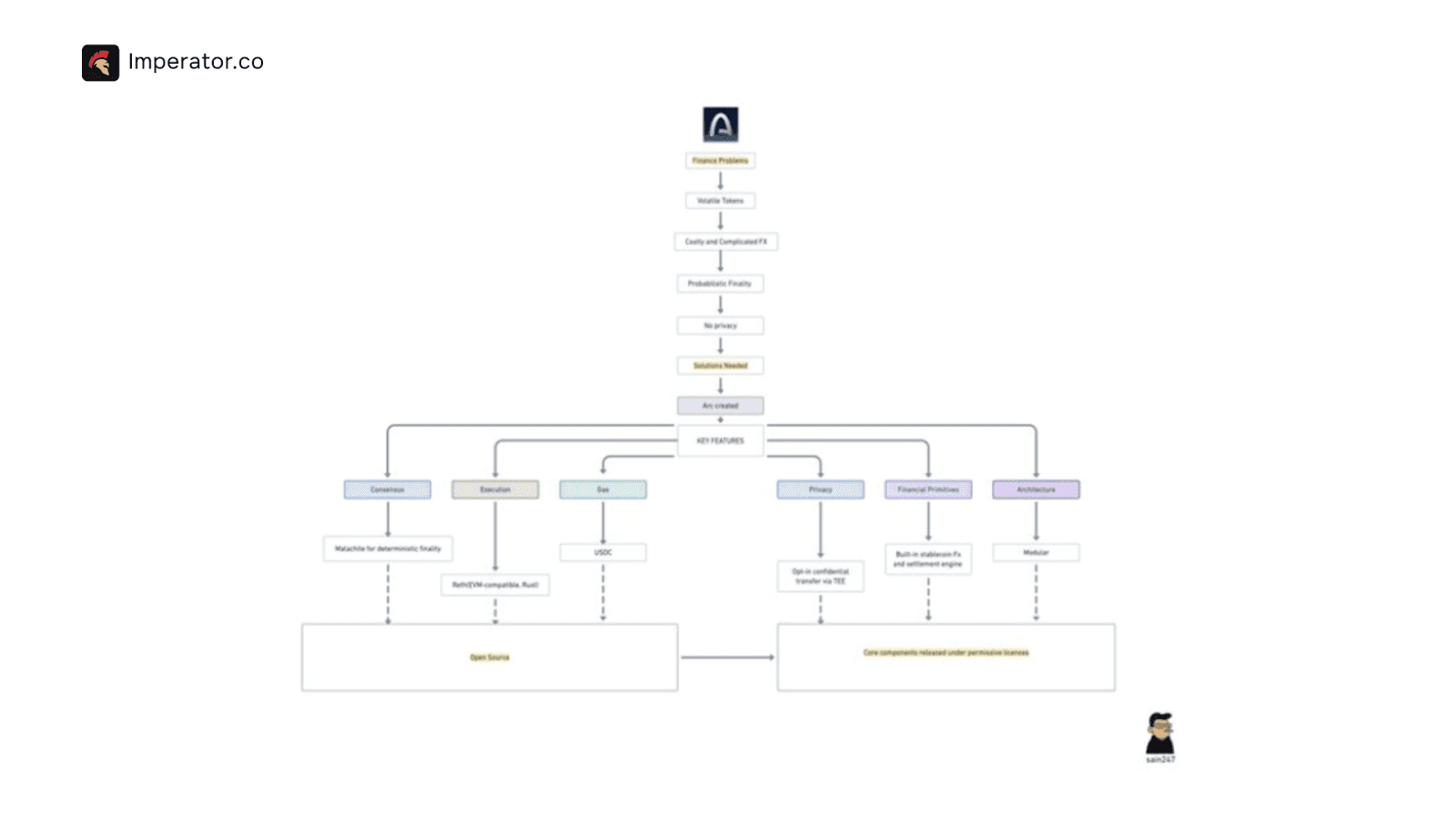

Arc is an open Layer 1 (L1) blockchain being developed by Circle designed to cater to developers and companies facilitating real-world economic activity by being purposefully built to support financial transactions based around stablecoins and stablecoin-native applications. Some features of Arc that contribute to its uniquely finance-focused architecture include its Malachite Tendermint Byzantine Fault Tolerant (BFT) consensus layer, a built-in institutional grade FX engine for price discovery, a predictable dollar-based fees market using USDC as its native gas token, simplified block times timestamped with real times instead of epochs or slots, and the capability for opt-in configurable private transactions via TEEs. In addition to this, Arc is also a public EVM compatible network and includes native integration with both of Circle’s cross chain products, Gateway and Cross Chain Transfer Protocol (CCTP). This ensures that developers on Arc can deploy and interact with smart contracts they are familiar with while users can easily bridge and access USDC liquidity across Arc and a number of other chains.

Each of these features are integrated with Arc to remove the biggest adoption barriers for regulated participants and serve its purpose of being the premier chain for stablecoin transactions, stablecoin applications, and to be the next destination for the wave of incoming global blockchain customers: fintechs, payment service providers (PSPs), financial institutions, and global enterprises. Some of the entities who understand the impact that a blockchain like Arc could have and have already signed on to begin using Arc include Apollo, Amazon Web Services, Mastercard, Visa, Goldman Sachs, and BlackRock.

Architectural Technical Analysis

Arc blockchain’s infrastructure has been specifically architected to make it a blockchain capable of supporting institutional grade financial transactions. Arc was specifically designed to solve issues like volatile gas tokens and unpredictable fee markets, costly and complicated foreign exchange, fragmented liquidity, probabilistic finality, and a lack of transparent privacy controls, all of which need to be addressed before institutions arrive on chain. Arc’s tech stack includes specific infrastructure to tackle each of these problems.

As a result of each of these technological improvements, the Arc blockchain will allow for a world where financial apps are as easily accessible as email, dollars, euros, pesos, and other fiat currencies can move anywhere almost instantaneously, private transactions that comply with relevant regulations can happen at scale, and AI agents can transact and coordinate commercial activity autonomously.

EVM Compatibility: Although Arc is its own standing L1 blockchain, its underlying infrastructure and code is EVM compatible, meaning developers will be able to deploy and interact with on-chain contracts while using tools, languages, and frameworks that they are already familiar with. This includes products like Solidity, Foundry, and Hardhat.

Additionally, this means that preexisting protocols and developers who have already deployed contracts on other EVM-based chains can much more easily transfer and configure contracts to deploy on to Arc.

Arc also ensures that despite its usage of USDC as its native network token, developers will have access to a native balance version with eighteen decimals and an optional ERC-20 interface for the USDC contract address that will provide the same capability as USDC on other EVM networks with ERC-20 allowances, the transferFrom function, and the six decimal format to match the standard USDC representation.

Malachite BFT Consensus Layer: Arc uses Malachite for its consensus layer, a high performance yet flexible implementation of the Tendermint Byzantine Fault Tolerant consensus protocol originally developed by Informal Systems. Malachite Tendermint’s core safety and liveness model includes rotating proposers that assemble each block, validators that run two separate rounds, a prevote and a precommit round, which ultimately results in a block that is finalized when more than two‑thirds of the validators precommit the block. The two separate rounds of voting are fundamentally necessary for the Malachite BFT Fault Tolerance protocol to operate with optimal resilience to potential threat actors.

As a result of this process, it provides the chain and transactions with deterministic finality and no potential chain reorganizations. This is especially important for Arc users because deterministic finality eliminates reorg hedging and “wait N blocks” heuristics common to probabilistic chains. For institutional workflows, this reduces operational risk, shortens settlement windows, and simplifies policies around irrevocability, escrow release, and cutoffs.

Arc pairs Malachite with a permissioned Proof‑of‑Authority (PoA) validator set composed of known and regulated institutions, optimizing for predictable performance and institutional accountability. This includes entities who have achieved and maintain SOC 2 certification that are also geographically distributed across the world to ensure reliance of the chain. However, Arc does mention in its docs that some time in the future, Arc may potentially evolve from the current PoA model to a permissioned Delegated Proof-of-Stake (DPoS) model in order to allow for broader validator participation while continuing to maintain regulatory compliance.

Users can view the Malachite Github repository here which includes the Rust implementation of the consensus algorithm, a whitepaper describing the core consensus algorithm, documentation pertaining to the model, and different protocol specifications.

Opt-In Privacy: As large financial institutions like Blackrock and Goldman Sachs and sovereign countries like Abu Dhabi onboard their services and users to Arc, a need for privacy grows. As a result, Arc is integrating the ability to facilitate private transactions within its own infrastructure, allowing users to selectively shielded balances and transactions. This is crucial for clients to protect themselves, protect their users, and stay compliant with their obligations and relevant regulations. Arc is able to facilitate private transactions and confidential transfers via a Trusted Execution Environment (TEE), a trusted enclave outside the public execution environment that computes over shielded data to produce attested results.

In addition to providing the option for privacy, Arc’s privacy is designed to be auditable where counterparties can selectively reveal proofs or provide view access to regulators, auditors, and compliance teams without exposing broader business logic or unrelated balances. Typical patterns include private payroll, vendor payments with confidentiality, confidential FX hedges, and institutional fund transfers.

Stable Fee Model (USDC Native Gas): Arc uses USDC as its native gas token, meaning its base fee, priority fee, and validator rewards are all denominated and directly paid in USDC. As a result of this, Arc users do not need to hold or swap for a volatile gas token in order to submit a transaction to the blockchain. Denominating fees in USDC removes price volatility from the fee estimation equation. This will allow users to pre‑approve spend in dollars, set policy thresholds, and meter usage with clean accounting.

Arc’s fee market includes a fee smoothing mechanism built as a variation of Ethereum’s EIP-1559 that changes how the base fee adjusts. Instead of recalculating fees for every block, Arc keeps its base fees bound, keeping costs low while also using an exponentially weighted moving average (EWMA) of block utilization to calculate priority fees. This means that during times of high demand for the blockchain, fees will adjust gradually, not abruptly, and stay relatively predictable for developers and users.

Alongside Arc’s Stable Fee Model, Arc will include a built-in foreign exchange machine to support other stablecoins and allow them to be programmatically converted into USDC to pay for fees, avoiding separate refueling transactions and reducing balance fragmentation.

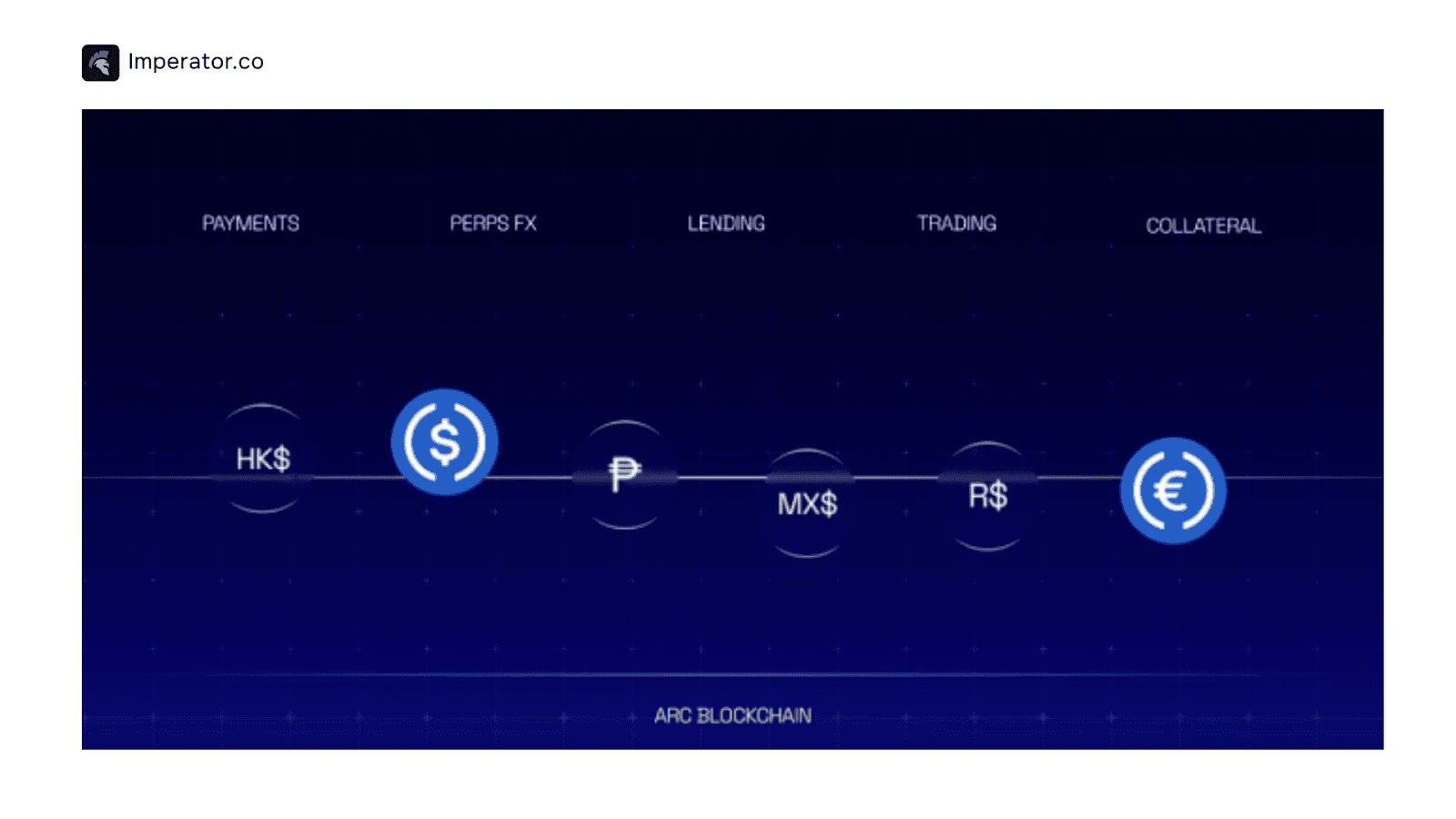

Built-in FX Engine: Within Arc’s own infrastructure includes a foreign exchange engine that provides an institutional grade Request for Quote (RFQ) system that allows for token price discovery and 24/7 payment versus payment (PvP) on chain settlement. Typical flows include invoicing in local currency stablecoins, on‑chain RFQ pricing, and atomic PvP settlement to USDC, thus removing principal risk and avoiding split‑leg timing mismatches. Market makers and banks can also stream quotes, tighten spreads via deterministic finality, and integrate surveillance with enterprise risk systems. This means that all Arc users will be able to conduct cross currency trades that finalize and settle atomically, eliminating principal risk and aligning with enterprise requirements for synchronized delivery versus payment and payment versus payment (DvP/PvP) flows.

Block Production: Under normal operation, Arc targets sub‑second deterministic finality and multi‑thousand transactions per second (TPS), with published benchmarks showing ≳3,000 TPS at 20 validators and <350 ms finality, and higher throughput with smaller committees. The Arc roadmap includes plans for multi-proposer support which can potentially increase throughput of the chain by ~10X and consensus optimizations that can cut latency by ~30%.

Arc also prioritizes consistent block times in the sub-second range with block times being stamped using real-time instead of block numbers to provide reliable and predictable transaction processing. This is crucial for institutional risk management and real-world finance applications when operating on chain.

In practice, sub‑second finality collapses user wait times at checkout, enables instant confirmations for remittances, and supports low‑latency market infrastructure, for example. Additionally, market makers, oracles, and clearing flows can operate with bounded latency and predictable settlement windows.

Native Cross Chain Capability: Arc’s infrastructure includes the integration of Circle’s cross chain products, Gateway and Cross Chain Transfer Protocol (CCTP). Gateway is Circle’s enterprise API layer for stablecoin operations such as managing wallets, operation mint/burn protocols, issuing payouts, and maintaining policy controls so that teams can issue, move, and settle value across chains without the requirement of third party services. CCTP is Circle’s cross‑chain USDC transport bridging service that bridges canonical USDC between different chains and manages on chain USDC liquidity.

Arc Ecosystem

As was briefly mentioned in the introduction, the Arc Ecosystem is already expansive despite only being in its public testnet phase. The Arc Ecosystem includes a wide range of different fintech companies, payment service providers (PSPs), financial institutions, and global enterprises that are participating in order to support the development of stablecoin transactions and stablecoins as a trusted and used payment rail.

Capital Markets: The Capital Markets category refers to entities who facilitate and assist in the process of capital formation, or fundraising money, for corporate investment and government financing. Capital formation can be done in a number of ways like primary and secondary offerings via a number of various tools such as stocks, bonds, and other securitized products. This process typically involves a number of different types of firms including issuers, institutional and retail investors, underwriters, exchanges, custody providers, clearing houses, and regulators. Capital market firms now see blockchains and specifically Arc as a viable destination to facilitate capital formation.

Some of the leading capital market firms that have already engaged with Arc include: Apollo (APO:NYSE), BNY (BK:NYSE), Intercontinental Exchange Inc (ICE:NYSE), State Street (STT:NYSE).

Banks, Asset Managers, and Insurers: After capital is formed, it is typically sold to investors looking to participate in the deal, which requires entities like retail and institutional banks, asset managers, and insurers, who are all crucial purveyors of capital, credit, investing, payments, and treasury infrastructure worldwide. Many of these banks and asset managers are in the process of understanding how managing the sale and distribution of capital can be augmented by blockchain infrastructure and specifically, the Arc blockchain.

Some of the leading banks, asset managers, and insurers that have already engaged with Arc include: Absa (ABG:JSE), Bank Frick, BlackRock Inc. (BLK:NYSE), BTG Pactual (BPAC11:B3), Clearbank, Commerzbank (CBK:FWB), Deutsche Bank (DB:NYSE), Emirates NBD (EMIRATESNBD:DFM), First Abu Dhabi Bank (FAB:ADX), FirstRand Bank (FSR:JSE), Fiserv (FI:NYSE), Goldman Sachs (GS:NYSE), HSBC (HSBA:LSE), Invesco (IVZ:NYSE), Kyobo Life, SBI Holdings (8473:TSE), Société Générale (GLE:EPA), Standard Chartered (STAN:LSE), WisdomTree (WT:NYSE).

Global Payments, Technology, and Fintech Ecosystems: Stablecoins have blossomed to be identified as one of crypto’s first “killer apps” and Arc is specifically designed to take advantage of this by creating payments rails to facilitate stablecoin transactions. The goal is to onboard and facilitate frictionless and automatic payments between a broad array of technology and payment-focused firms spanning global technology leaders, fintech companies, cross-border payments providers, retail payment networks, B2B payments, remittance payment providers, and e-commerce platforms.

Some of the leading global payment, technology, and fintech companies that have already engaged with Arc include: Amazon Web Services (AWS) (AMZN:NASDAQ), Brex, Careem, Catena Labs, Cloudflare (NET:NYSE), Corpay (CPAY:NYSE), dLocal (DLO: NASDAQ), Dmall, Ebanx, FIS (FIS:NYSE), Hecto Financial, LianLian, Mastercard (MA:NYSE), Mercoin, Noah, Nuvei (NVEI:NYSE), Pairpoint by Vodafone (VOD:LSE), Paysafe (PSFE:NYSE), PhotonPay, Ramp, Sasai Fintech – a business of Cassava Technologies, Sumitomo Corporation (8053:TSE), Visa (V:NYSE), Yellow Card.

Stablecoins and Asset Issuers: Building off the point above, Arc specifically focuses on providing core infrastructure in order to support various issuers of fiat stablecoins, tokenized equities, credit funds, and money market funds. Arc plans to include the involvement of multiple stablecoin issuers in its core native infrastructure via stablecoin swaps and exchange liquidity to allow users to pay for USDC gas fees in other currency-based stablecoins.

Some of the leading stablecoins and stablecoin issuers that have already engaged with Arc include: AUDF issued by Forte Securities, BRLA issued by Avenia, JPYC issued by JPYC Inc., KRW1 issued by BDACS, MXNB issued by Juno (a Bitso company). PHPC issued by Coins.PH, QCAD issued by Stablecorp.

Blockchain and DeFi Infrastructure: Since Arc is its own standing L1 blockchain, it requires a number of blockchain infrastructure and developer tooling that are crucial to the facilitation of blockchain interaction and involvement. Some of the infrastructure and tooling providers who have integrated or plan to integrate with Arc include:

Digital Wallet Infrastructure: Bron, Exodus, Fireblocks, Hecto Innovation, Ledger, MetaMask, Privy, Rainbow, Turnkey, Vultisig connect Arc into desktop and mobile app experiences.

Developer Tools: Alchemy, Chainlink, Crossmint, Dynamic, Fun.xyz, LayerZero, Pimlico, Thirdweb, ZeroDev support builders with frameworks and kits.

AI: Building on Anthropic's Claude Agent SDK to enrich the developer experience on Arc with AI-powered dev tools.

Cross Chain Bridging: Circle’s CCTP, Across, Stargate, Wormhole connect Arc to other blockchain networks.

Blockchain Infrastructure: Blockdaemon, Blockscout, Bridge, Elliptic, Quicknode, Ramp Network, Tenderly, Transak, TRM help keep Arc accessible, performant, compliant, and reliable.

Decentralized Exchanges (DEXes): Curve, Dromos Labs (Aerodrome, Velodrome), Euler Finance, Fluid, Uniswap Labs provide decentralized trading and liquidity pools.

Centralized Exchanges (CEXes): Bitvavo, ByBit, Coinbase (COIN:NASDAQ), Coincheck (CNCK:NASDAQ), Hashkey, Kraken, Robinhood (HOOD:NASDAQ) expand access points into the Arc ecosystem.

Market Makers and OTC Trade Desks: Auros, B2C2, Cumberland, Galaxy Digital (GLXY:NASDAQ), GSR, IMC, Forte Securities, Keyrock, NONCO, Wintermute, Zodia Markets provide efficient access to liquidity globally.

Borrow/Lend Protocols: Aave, Maple, Morpho enable credit and capital efficiency with stablecoins and tokenized assets.

Yield Generation: Centrifuge, Superform, Securitize power various stablecoin-native yield opportunities across the ecosystem.

Tokenized Fund Issuers: WTGXX and CRDT by WisdomTree (WT:NYSE) provide access to yield-bearing tokenized investment funds.

Institutional Custodians: BitGo, Copper, Taurus, Zodia Custody provide digital asset storage for institutions.

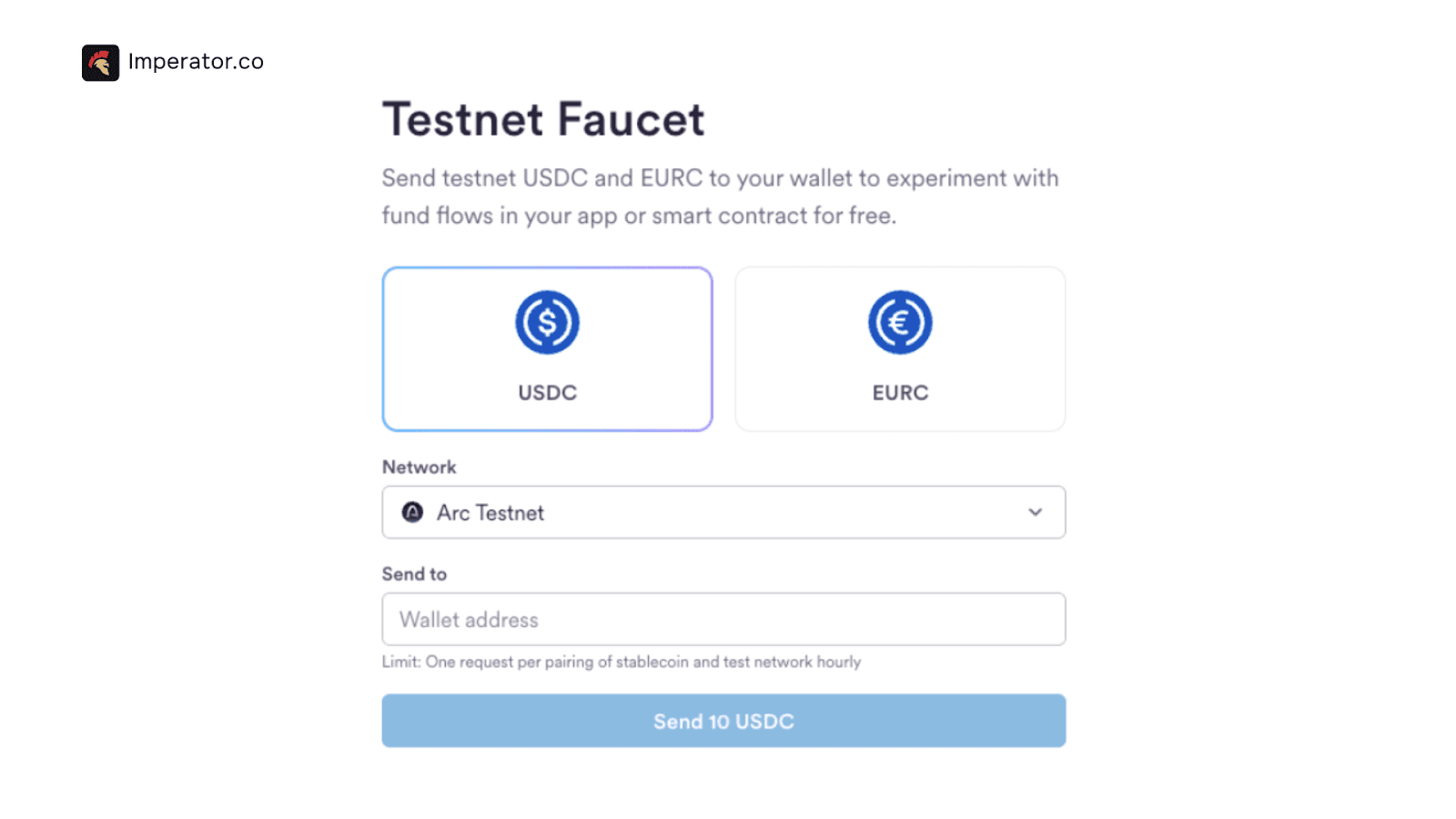

As of writing, any developer or user can join the Arc ecosystem and interact with the Arc public testnet right now by requesting starting funds and exploring the blockchain. Arc’s Docs are linked here, the testnet explorer is linked here to track all transactions, and the testnet faucet is linked here so you can request either USDC or EURC to begin executing transactions.

0 clients stake with Imperator.co

0 clients stake with Imperator.co

Start staking with Imperator and maximize your rewards.

Standout Arc Ecosystem Protocols

Outside of the large institutions that have signed on to begin using Arc, Arc is already beginning to foster a thriving grassroots ecosystem during its public testnet phase. Some protocols leading the charge include:

TIBA: TIBA is an AI medical billing assistant that automates coding, claims, and payments, settling instantly with USDC on Arc for secure transaction management. By automating revenue cycle operations with USDC on Arc, TIBA is able to bring faster cash collections, transparent audit trails, and reduced dispute cycles, all of which are key improvements for healthcare providers and insurers.

Arc Pay: Arc Pay by Superface is “Apple Pay for AI agents,” a payments layer built on Arc using USDC that lets autonomous agents initiate and complete payments with deterministic finality and real timestamps that make compliance, receipts, and retries much more straightforward.

SOLRARC: SOLRARC is an AI-managed real‑world asset protocol that automates proof‑of‑generation and settlement, leveraging Arc plus Circle’s CCTP for cross‑chain USDC transfers to run an end‑to‑end on‑chain asset lifecycle.

MintAura: MintAura is an NFT platform that lets creators mint, manage, and earn rewards from digital assets.

Tokenomics/Governance

As of writing, Arc is still in its public testnet phase and not yet in mainnet but Circle mentioned in its third quarter earnings call that it is “exploring the possibility” of a native token for Arc. Although few details were released regarding what would entail the launch and utility of a native Arc token, speculation sees the potential of a native token launching in order to foster network participation to drive up adoption of the blockchain.

Although this could mean a plethora of different intentions for a potential native Arc token, Circle has mentioned an eventual path for Arc to be operated and governed by a broad, globally distributed set of participants including financial institutions, technology platforms, infrastructure providers, and protocol developers. A native Arc token could eventually become the governance token for the entire Arc blockchain and ecosystem, managing widespread and influential change for each individual stakeholder.

Additionally, a future Arc token could be integrated into Arc’s consensus mechanism if they stay on the roadmap to eventually transition from a Proof of Authority (PoA) chain to a Delegated Proof of Stake (DPoS) chain. If Arc transitions to DPoS, a native Arc token will most likely be used as the native staking token to economically secure the validators validating the transactions on chain.

Competitive Analysis

The competitive field includes stablecoin‑focused L1s that prioritize fee predictability and fast finality, alongside general‑purpose L1/L2 ecosystems with deep liquidity and tooling. Arc’s differentiator is its native stablecoin economics, auditable privacy, institutional FX/PvP, and Circle‑operated liquidity pathways, all of which are specific features built for regulated payments and capital markets. A deeper dive into the different stablecoin chains that exist and how each chain’s consensus mechanism, execution layer, user experience (UX), bridging capabilities, support for enterprise needs, and ability to facilitate private on chain transactions can be found here.

Arc | Plasma | Tempo | Gnosis | Stable | |

|---|---|---|---|---|---|

Consensus | Malachite (BFT) | PlasmaBFT | Commonware | Proof of Stake (PoS) | CometBFT, Proof of Stake (PoS) |

Txn Fee | Predictable, low (USDC) | 0 for USDT Txns | Predictable, near-zero (stablecoin) | ~$0.0001 (stable) | Low |

Gas | USDC | XPL, USDT | Stablecoins | xDAI | USDT |

Finality | Sub-second deterministic | Sub-second deterministic | Sub-second target | ~5 seconds | Sub-second deterministic |

Virtual Machine | EVM | EVM | EVM | EVM | EVM |

Bridging | CCTP | Native BTC Bridge, LayerZero | Unknown, likely via Stripe rails | Gnosis Bridge | LayerZero |

Privacy | TEEs | Stealth address transfers, ZK | Unknown, maybe ZK | None | Zero-knowledge proofs (ZK) |

Discover all our Staking Opportunities

Acces over 50+ protocols to maximize your staking returns

Closing Thoughts: Arc’s Future

Although Arc faces stiff competition from other stablecoin based blockchains such as the Bitfinex backed Plasma and Stable blockchains or the Stripe backed Tempo blockchain, Arc continues to hold the advantage under its backing entity, Circle. Circle is comfortably positioned as the leading stablecoin issuer that is compliant under the current regulatory environment. As a result, it continues to hold a strong competitive advantage, especially in the United States, in the epicenter of the global financial industry.

Building on its pre-existing regulatory and first-mover foundation, Arc is acutely positioned to become the stablecoin “operating system” for digital finance: dollar‑denominated gas with predictable fees, sub‑second deterministic finality, and real‑time block timestamps align settlement semantics with enterprise SLAs; native interoperability via CCTP and Gateway routes canonical USDC across chains while Arc’s built‑in RFQ/PvP FX engine enables atomic cross‑currency settlement; opt‑in auditable privacy unlocks institutional workflows; and EVM compatibility keeps developer migration friction low.

Additionally, as governance and validator participation broaden over time, and the roadmap delivers multi‑proposer throughput, paymaster‑supported multi‑stablecoin fee payments, and deeper capital‑markets primitives (DvP/PvP, tokenized fund rails, treasury automation), Arc can consolidate liquidity and compliance‑grade infrastructure into one stablecoin‑native L1, making it the default venue for payments, FX, and tokenized assets, especially for U.S.-based institutions seeking regulatory clarity and operational certainty.

As we look forward to Arc’s mainnet launch, adoption is likely to track where stablecoin utility is largest in cross‑border payouts, merchant settlement, B2B invoices, tokenized fund issuance, and FX hedging. Success will hinge on three levers, continued institutional onboarding, developer velocity on EVM tooling, and demonstrable compliance outcomes, all of which reinforce Arc’s positioning as the stablecoin‑native base layer.

Look out for when Arc exits its public testnet phase and enters mainnet beta some time in 2026. Follow Arc at @arc on X or join Arc’s Discord using this link to follow Arc’s developments and to know exactly when mainnet is launched.

$0 assets under managment

$0 assets under managment

Join investors who trust Imperator to maximize their returns. Take the first step today.